WHO WANNA JOIN CONSISTENT PROFITS FIl THIS

JOIN SURVEY LINK

1 K PER MONTH FOR DONATIONS WE USE

https://surveyheart.com/form/5f41cf1eb76fd61d67738de7#welcome

AS I POSTED YESTERDAY 11600 -620 RES

NEED CORRECTION ALL DAY RANGE WITH CORRECTION DONE

I DID ONE TRADE TODAY AS I POSTED

202 LOW MADE I BOUGHT 500 Q

HIGH WAS 280 I SOLD VERY LOW 235

CLOSING

NIFTY CHART:

STOCKS GAINERS AND LOSERS:

stocks to focus tomr long build up:

short buildup :

MK SHORT LISTED STOCKS FOR INTRADAY:

VOLUME GAINERS:

MK SHORT LISTED BULLISH STOCKS

STOCK NEWS:

Expert's view on the market: Manish Hathiramani, Index Trader and Technical Analyst, Deen Dayal Investments

We did not spend too much time above 11,600 levels and gave up most of the gains in the second half of the session.

Expiry days are expected to be volatile. What needs to be seen is whether we can keep above 11,600 in the new session tomorrow and in the following week.

This would indicate a new high of close to 11,700-11,800 for the September expiry.

The support of the Nifty is at 11,300 and till that level is not breached, we are in positive terrain.

Market closing: Market benchmarks ended in the green for the fifth consecutive session on August 27, supported by gains in select heavyweights such as HDFC, Axis Bank, Mahindra & Mahindra, SBI, ICICI Bank and IndusInd Bank.

However, losses in shares of Reliance Industries, HDFC Bank, Kotak Mahindra Bank and Infosys offset most gains of the benchmark.

Sensex closed 40 points, or 0.10 percent, up at 39,113.47 and Nifty settled 10 points, or 0.84 percent, up at 11,559.25.

BSE Midcap index closed flat while the Smallcap index ended 0.35 percent higher.

Among the sectoral indices, BSE Energy fell over a percent. Oil & Gas, Utilities, Telecom, FMCG also ended in the red. On the other hand, BSE Realty surged 6.63 percent.

Buzzing stocks: Shares of IndusInd Bank surged over 9 percent while those of State Bank of India (SBI) climbed over 3 percent in intraday trade on BSE on August 27 after the global financial firm UBS upgraded the stocks to 'buy' from 'sell'.

"Bank stocks are down 12-62 percent year-to-date and have underperformed the broader markets. We think the sector’s downside risks are limited and upgrade IndusInd Bank and SBI from sell to buy," UBS said in a note.

UBS has a target price for IndusInd bank at Rs 675 and for SBI at Rs 260.

"We reduce FY21E GNPL formation and credit costs but raise our NIM estimates, resulting in a 17-115 percent lift in FY21E earnings for the banks we cover. Our estimates are 4-30 percent higher than consensus for select coverage banks," UBS said.

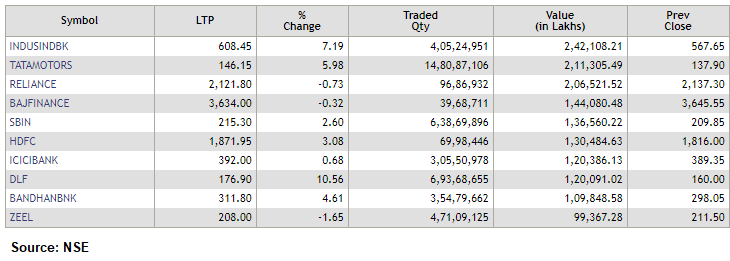

ACTIVE STOCKS:

Tapan Patel- Senior Analyst (Commodities), HDFC Securities: Crude oil prices traded flat with NYMEX WTI Crude oil prices kept the firm trading range above USD 43 on Thursday. MCX Crude oil September futures were trading down by nearly 1 percent on sharp rupee appreciation to Rs 3202 by noon. Crude oil prices are holding firm range as US Gulf coast refineries and offshore operating facilities are bracing for impact from Hurricane Laura. Hurricane Laura poses the region’s biggest storm threat since Hurricane Katrina in 2005, which caused a 90 percent shutdown. The lower demand on slower economic growth has kept upside limited in crude oil prices.

We expect oil prices to trade sideways to up for the day with support at USD 42 and resistance at USD 45 MCX Crude oil September futures has support at Rs 3150 with resistance at Rs 3270.

Rupee ends: Rupee ends at 73.81 per US dollar against August 26 close of 74.30 per US dollar

0 Comments