MK PREMIUM CALLS --

THOSE WHO WANT TO JOIN THE SERVICE

AS 1000 PER MONTH

FOR CONSISTENT PROFIT

JOIN SURVEY LINK

https://surveyheart.com/form/5f41cf1eb76fd61d67738de7#welcome

NIFTY LEVELS AUG 23

NIFTY FACING 400 ,460 MULTIPLE TIMES

DOWN CHANNEL PATTERN WE CAN SEE

AS PER OI 400 -500

AS HIGH WEIGHTS REL FACING RES ON 2120 SUP OF 2070 IF BREAK EVEN LOW CAN

GO

NIFTY CHART KEY LEVELS

SUP - 11350 ,300, 230 180

RES - 400 , 420 , 460

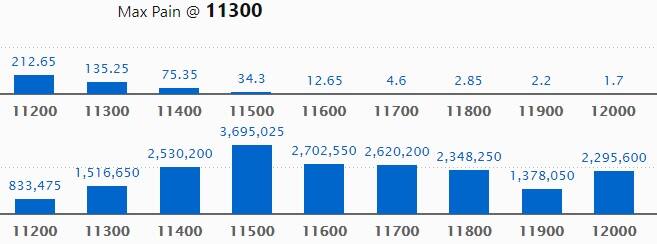

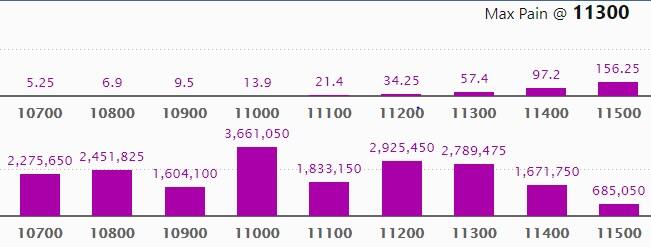

AS OI OI KEY LEVELS

TO WATCH

11400 AND 11500 FACING RES BELOW WE HAVE 11300 AND 11200

CALL DATA

PUT DATA

Stocks with a high delivery percentage

A high delivery percentage suggests that investors are showing interest in these stocks.

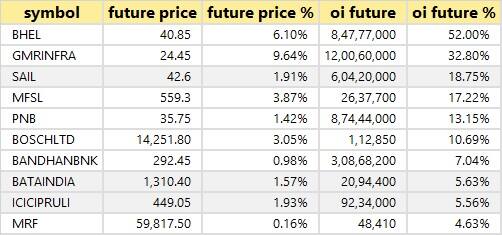

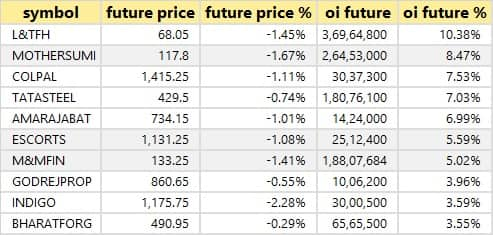

LONG BUILD UP STOCKS TO WATCH

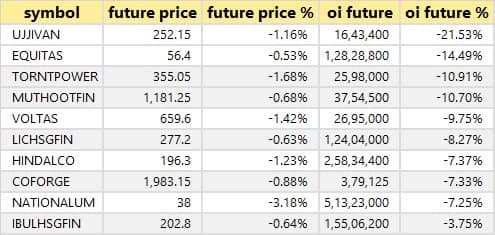

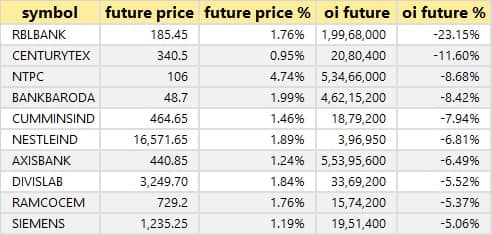

stocks saw short build-up

SHORT COVERING

Stocks in the news:

Indiabulls Housing Finance Q1: Profit at Rs 272.8 crore versus Rs 790 crore, revenue at Rs 2,574.6 crore versus Rs 3,885 crore YoY.

SMS Lifesciences Q1: Profit at Rs 2.48 crore versus Rs 4.7 crore, revenue at Rs 54.7 crore versus Rs 91.8 crore YoY.

Rossari Biotech Q1: Profit at Rs 15.5 crore versus Rs 14.16 crore, revenue at Rs 109.5 crore versus Rs 127.8 crore YoY.

Max Healthcare Institute: Ashish Dhawan held 1.78% stake in company and FPIs have 10.87% shareholding as of June 2020.

AGC Networks Q1: Profit at Rs 4.33 crore versus Rs 13.56 crore, revenue at Rs 993.86 crore versus Rs 1,228.47 crore YoY.

Genus Paper & Boards Q1: Loss at Rs 5.48 crore versus profit Rs 2.1 crore, revenue at Rs 31.35 crore versus Rs 70.12 crore YoY.

Union Bank of India Q1: Profit at Rs 332.74 crore versus Rs 224.43 crore, NII at Rs 6,403.2 crore versus Rs 2,518.19 crore YoY.

Stock under F&O ban on NSE

Nine stocks -- Adani Enterprises, Aurobindo Pharma, Bharat Heavy Electricals (BHEL), Canara Bank, Indiabulls Housing Finance, Muthoot Finance, NALCO, Punjab National Bank and RBL Bank -- are under the F&O ban for August 24.

1 Comments

Useful info

ReplyDelete